Larimer County Property Valuations

May 3, 2023

Larimer County property valuations went in the mail this week, and property values have increased across the board. Values have increased sharply since the last reappraisal in 2021. New notice of valuation postcards will reflect the dramatic rise in property values in 2021 and 2022, the time frame on which this year’s valuations are based. This is occurring in many parts of the state and is not specific to Larimer County.

Why does your property valuation matter?

This will directly impact your property tax bill. Your property tax bill is based on two components, a tax rate and your property valuation. The tax rate includes mill levies by local taxing entities such as the school district, water districts, health district, county services, metro districts, the Town, library district, and more. These mill levies will not be set until later this year.

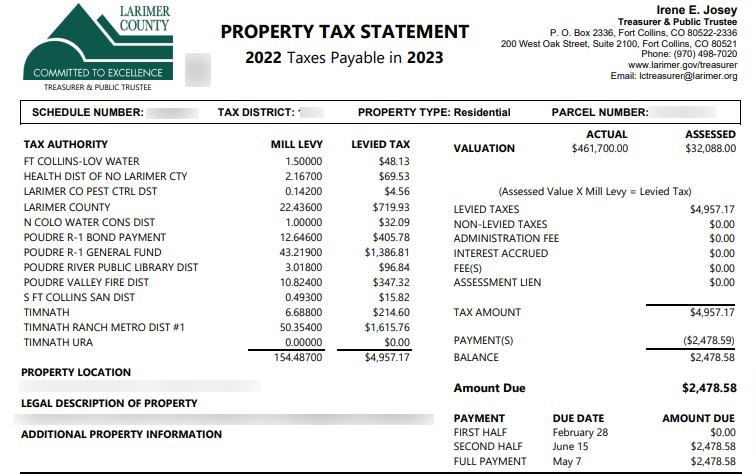

It is important to understand where your tax dollars go. The Town of Timnath received approximately 4% of the average property tax bill paid in 2022- about $215 on a Timnath home assessed at $460,000, while the overall property tax bill may be approximately $4,950.

Example based on the following real tax statement from 2022:

Don’t feel your property valuation is correct?

Owners who feel the valuation of their property is incorrect can protest their 2023 valuations with the Larimer County Assessor’s Office until midnight June 8.

There are several ways to submit a protest:

- Online: larimerassessor.org

- By scheduling an appointment: speak to a licensed appraiser from May 1 to June 8, at the Larimer County Assessor’s Office (200 W. Oak St., Fort Collins) or at the Larimer County Loveland Campus (200 Peridot Ave., Loveland)

- By dropbox: drop forms at 200 W. Oak St. in Fort Collins until the midnight, June 8, deadline

- By mail: mail an appeal to the assessor’s office- must be postmarked no later than June 8

Disabled veterans, senior homeowners qualify for exemptions

Disabled veterans and seniors may qualify to apply for the Colorado Senior Homeowner Property Tax Exemption and the Disabled Veteran and Gold Star Spouse Property Tax Exemption. The deadline to apply for the Disabled Veteran Property Exemption is July 1, and the deadline to apply for the Senior Property Tax Exemption is July 15.

Applications and information can be found at larimer.gov/assessor/exemptions.

Metro Districts

A metropolitan district, or “metro district,” is a special district and a local government unit authorized by Colorado state statutes, including the Special District Act (Section 32-1-101, et seq., C.R.S.).

Metro districts are organized to finance public improvements necessary for development to occur and provide ongoing operations and maintenance of certain public improvements. There are thousands of metro districts throughout Colorado and several in Timnath. While a metro district is a separate and independent entity, the Town Council reviews and approves the service plans for metro districts located within town boundaries.

Have questions about your metro district? Go to timnath.org/metro-districts for more info.